Blog

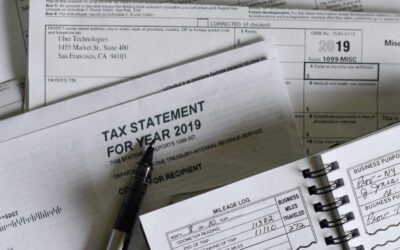

What happens in a tax investigation?

Latest update - July 2020 - Following the rush to implement businesses support in the wake of COVID-19, HRMC temporarily paused their usual tax investigation activities. However, they have now resumed these processes and paying particular attention to businesses that...

Self-Assessment – Why you should file early

It is of course so easy to put off your self-assessment tax return until later, perhaps even the last minute. However there are significant benefits to getting it done early and ensuring your tax affairs are up to date. Find out your Personal Tax Liability By filing...

What we’ll do for you

Find out more about how we help businesses in South West London and beyond and start building the right package of support to nurture your business.