What is Cryptocurrency?

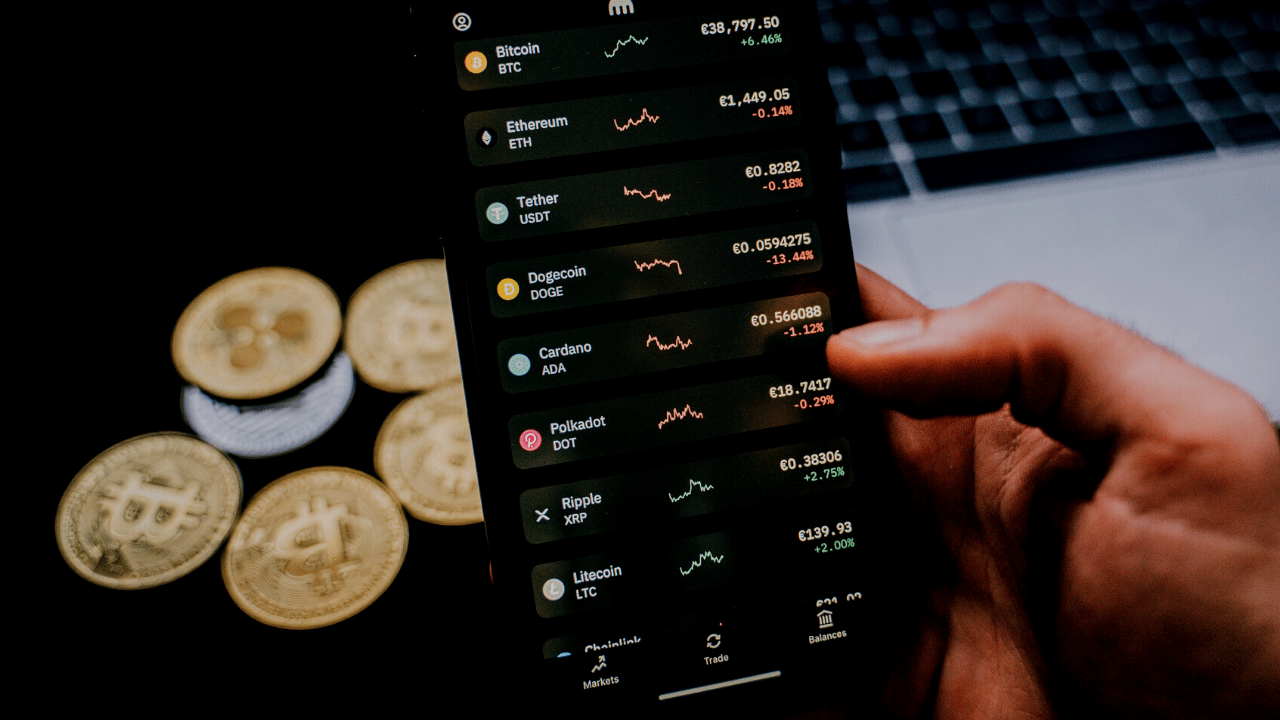

Cryptocurrency, also known as digital currency or virtual currency, is a type of digital or virtual asset that utilises cryptography for security. It is designed to function as a medium of exchange, just like traditional currencies such as the US dollar or euro, but operates independently of central banks and governments.

Cryptocurrencies are decentralized systems based on blockchain technology, which is a distributed ledger that records and verifies transactions across multiple computers or nodes. This technology ensures transparency, security, and immutability of transactions.

Unlike traditional fiat currencies, which are issued and regulated by central authorities, cryptocurrencies are typically created through a process called mining or are pre-mined. They exist in digital form and are stored in digital wallets, which can be software-based or hardware devices.

Understanding Taxable Cryptocurrency Transactions

It is crucial for individuals and businesses operating in the Cryptocurrency space to understand exactly which Cryptocurrency transactions are taxable. Whether it’s Cryptocurrency received as employment income, mining rewards, buying and selling tokens, exchanging Cryptocurrencies, using them for payments, or giving them as gifts, each transaction may have tax implications. Staying informed, complying with regulations, and seeking professional guidance will ensure smooth navigation through the complexities of Cryptocurrency taxation.

In addition to understanding taxable Cryptocurrency transactions, it is crucial to stay updated with regulatory changes too. The Financial Conduct Authority (FCA) has recently revised the Anti-Money Laundering (AML) Regulations to encompass specific activities related to Cryptocurrency transactions.

The revised AML Regulations now cover the following Cyrptocurrency activities involving Cryptocurrency transactions:

- Cryptocurrency Exchange Providers

- Cryptocurrency

- Peer-to-Peer Providers

- Issuing New Cryptocurrency

- Cryptocurrency Custodian Wallet Providers

These categories of business are ‘obliged entities’ under the new AML legislation, bringing them into line with traditional financial institutions such as banks. This means businesses in this sector are obliged to implement measures to counter money laundering. For example, undertaking customer due diligence KYC in the case of a Cryptocurrency exchange.

Taxable Cryptocurrency Examples

Given these developments, compliance with tax regulations is more critical when operating in the Cryptocurrency space. It is imperative to have a clear understanding of when Cryptocurrency transactions are taxable. Here are some key examples:

Cryptocurrency received as employment income: According to HMRC, if you receive Cryptocurrency as payment for employment, it is considered “money’s worth” and subject to Income Tax and National Insurance contributions. The employer is responsible for reporting and paying taxes based on the estimated value of the received Cryptocurrency.

Cryptocurrency received from mining: When Cryptocurrency is awarded to miners for verifying transactions and adding them to the blockchain, the sterling equivalent value of the received tokens is taxable. Whether mining activities constitute a taxable trade or miscellaneous income depends on individual circumstances and factors such as the nature and scale of the mining operation.

Buying and selling cryptocurrency: Profits or losses resulting from buying and selling Cryptocurrencies are generally taxable. HMRC’s default position is that financial trading activity is exceptional, meaning that most individuals or businesses engaging in Cryptocurrency trading will be subject to taxation on their gains.

Exchanging one cryptocurrency for another: If you exchange one type of cryptocurrency for another, any resulting profit or loss is subject to capital gains tax rules. It is important to note that no taxable event occurs if you retain beneficial ownership of the Cryptocurrency throughout the transaction, such as when moving tokens between wallets.

Using Cryptocurrency for Payments: Using cryptocurrency to pay for goods or services is considered a disposal, and the sterling equivalent of the cryptocurrency’s value at the time of the transaction is subject to taxation. It’s important to consider matching rules when using only a portion of an existing Cryptocurrency holding for transactions.

Giving Cryptocurrency: When gifting cryptocurrency to someone other than your spouse or civil partner, the sterling value of the gift is taken into account for Capital Gains Tax purposes, even if you don’t physically receive anything in return. Donating Cryptocurrency to a charity is usually exempt from tax, with exceptions for tainted donations or when gains are realized upon disposal.

We can help you

Our team at Kingston Burrowes has extensive experience helping and supporting hundreds of clients with Cryptocurrency portfolios or questions. To explore how we can support you, simply get in touch.